Yesterday we set out three factors that we think will determine the future rate and scale of public transport use. These are:

- Covid regulations and associated guidance: these reduce the demand for travel.

- Public transport capacity: the capacity of buses, trams and trains has been reduced. Sooner or later, with these restrictions in place demand will grow to a level that the capacity of public transport vehicles becomes the principal constraint.

- Changed behaviour: people don’t want to use the bus, catch a tram or take a train journey in the way they did pre-Covid.

The new lockdown in England will lead to an immediate drop in the use of public transport. But over time, restrictions will be relaxed. How may the first of our three factors affect the future demand for travel by bus and rail?

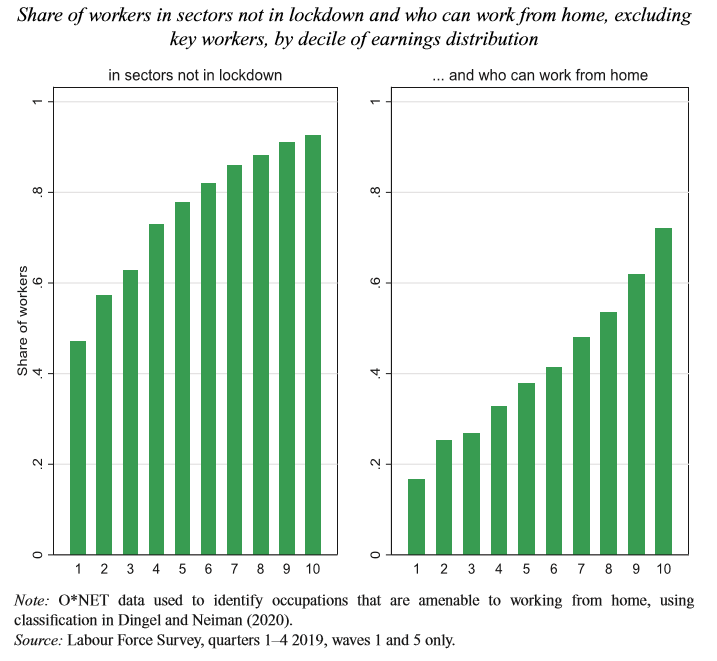

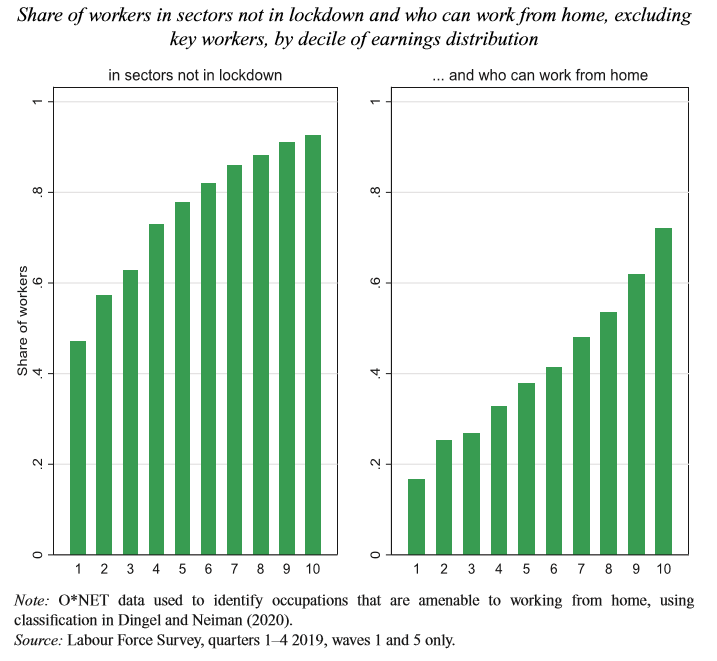

The chart below is reproduced from the paper COVID-19 and Inequalities1 by Richard Blundell and colleagues and published in the journal Fiscal Studies. The x-axis shows income deciles, with 1 being the least well-off 10% in society and 10 being the most well-off 10%. The y-axis shows the proportion in each decile who work in sectors not affected by lockdown (left panel), or who can work from home (right panel). What the left-hand panel shows is that the least well off in society are also the most likely to work in a sector most affected by lockdown. What the right-hand panel shows is that the better off are much more likely to be able to work from home.

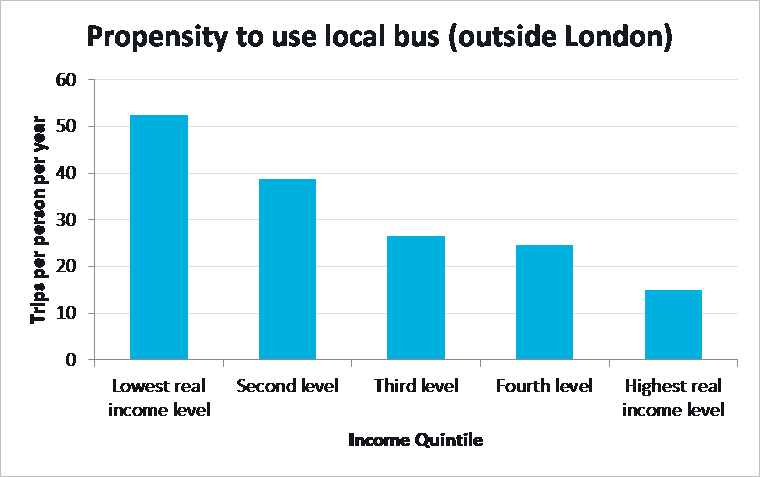

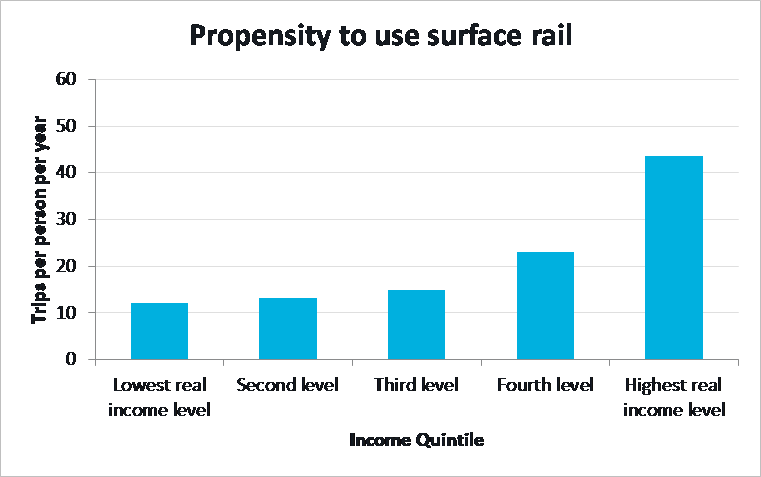

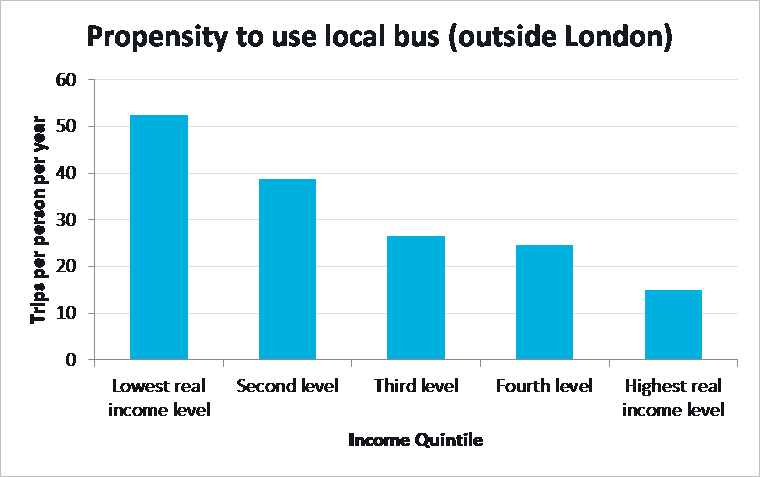

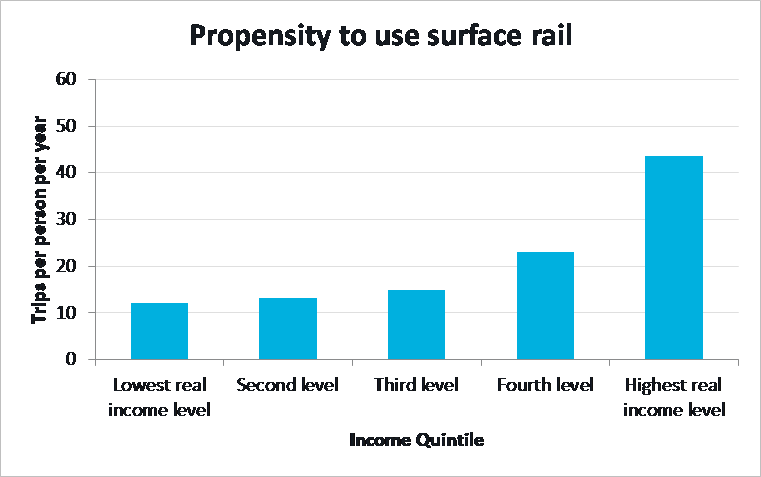

The two charts below use 2019 data from the National Travel Survey to show the propensity to use bus and rail for people in different income groups. Here the data uses quintiles rather than the deciles used by Blundell et al.

For bus users, what we see is that those with the lowest incomes have the greatest propensity to use bus. They are also more likely to work in a sector affected by lockdown and least likely to be able to work from home. For rail, we see the opposite. Those with the greatest propensity to travel by rail are also most likely to work in a sector less affected by lockdown, and they have the greatest ability to work from home.

We think this goes a long way to explain why pre-November lockdown bus patronage was at 55 to 60% of pre-pandemic levels, while train travel was no more than 35%. Bus is used more by those who cannot work from home. This, along with a sizeable number of bus journeys being to school or college is driving demand. In contrast, rail is used more by people who can work from home. This, combined with far fewer journeys being made for business or leisure, means rail’s demand recovery is much slower.

And in the future?

The November lockdown will have an immediate downward impact on demand.

In time, relaxing lockdowns should drive a recovery in bus patronage, but increasing unemployment will limit by how much. Nonetheless, it could well be that the requirement for social-distancing and the limit it places on bus capacity becomes a material constraint to the number of people travelling by bus. There is also the unknown of whether the elderly who have been most affected by the pandemic and are big bus users will return.

For rail, the question is how fast and to what extent will people return to their offices, as well as how long will it take for discretionary business and leisure travel to return. The rate of recovery may well be slower than bus, but it also looks like those with the greatest propensity to use rail will also be those least affected by the economic consequences of the pandemic.