In prohibiting the future sale of all but zero-emission vehicles, the UK and governments around the world have mandated our adoption of an alternative-fueled future. Sure, hydrogen generates headlines, but electric vehicle (EV) technology remains the viable response for cars, vans, buses & public service vehicles, micromobility, and even some of the heavier truck deployments. Rather than risk their access to key new car markets worldwide, global manufacturers (OEMs) have little choice but to quickly convert all their production to the new technology.

The Future will Look Nothing Like the Past

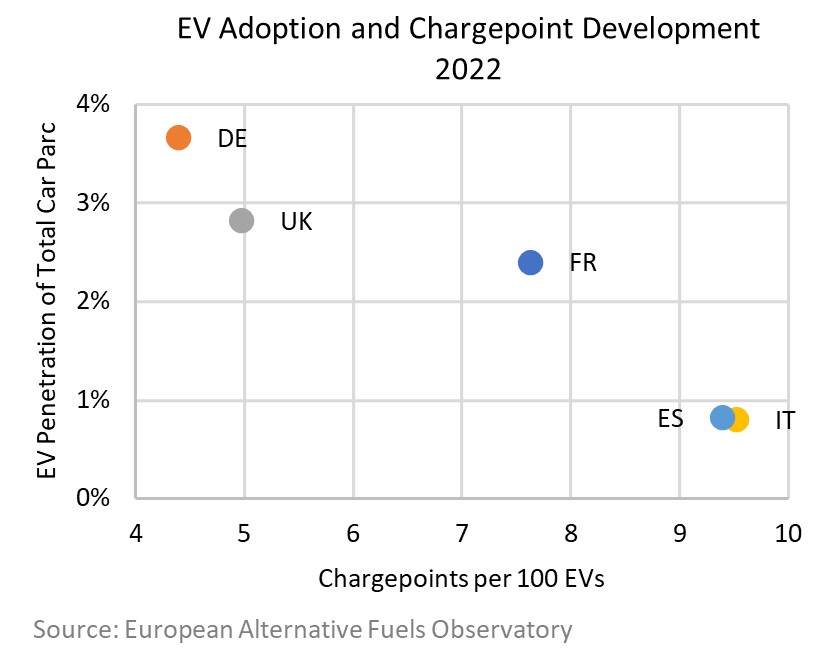

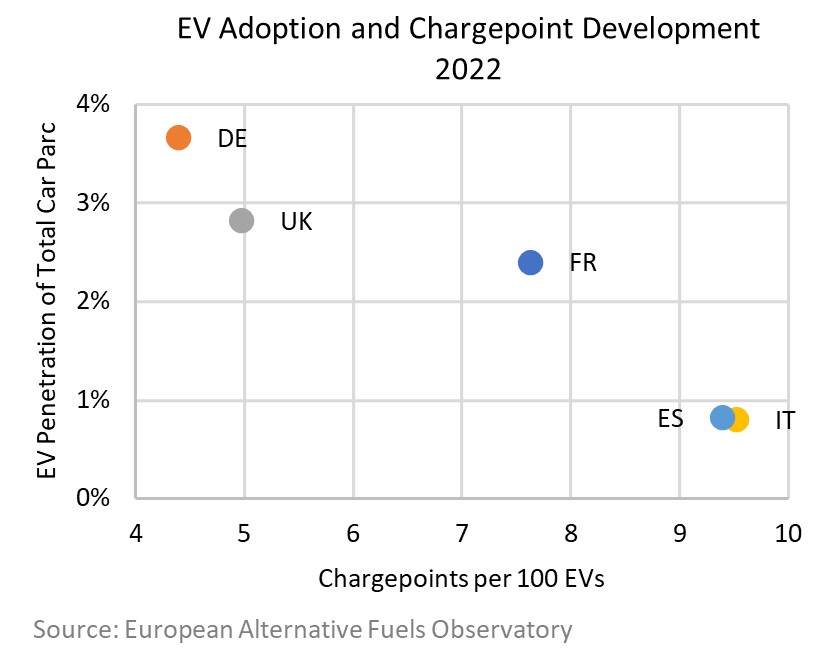

Investors exploring opportunities in EV charging infrastructure suffer a bit of a “left and right” problem. Today, with far less than 2% of the world’s car parc electrified, nobody really knows yet how, when, where, and at what cost EV drivers will choose to recharge. Looking left into history, there’s precious little experience with the financial performance of EV charging infrastructure. What little data there is is artificially negatively biased as investment efficiency typically over-serves diminutive demand.

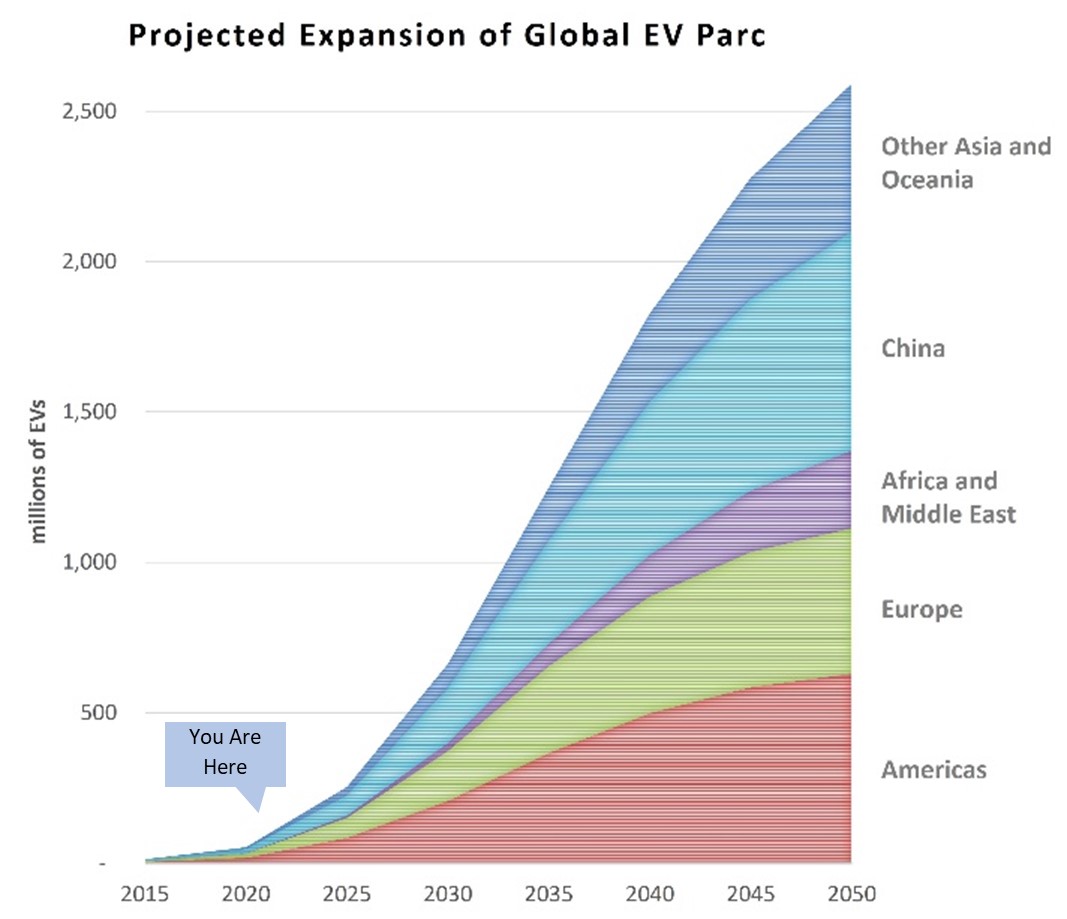

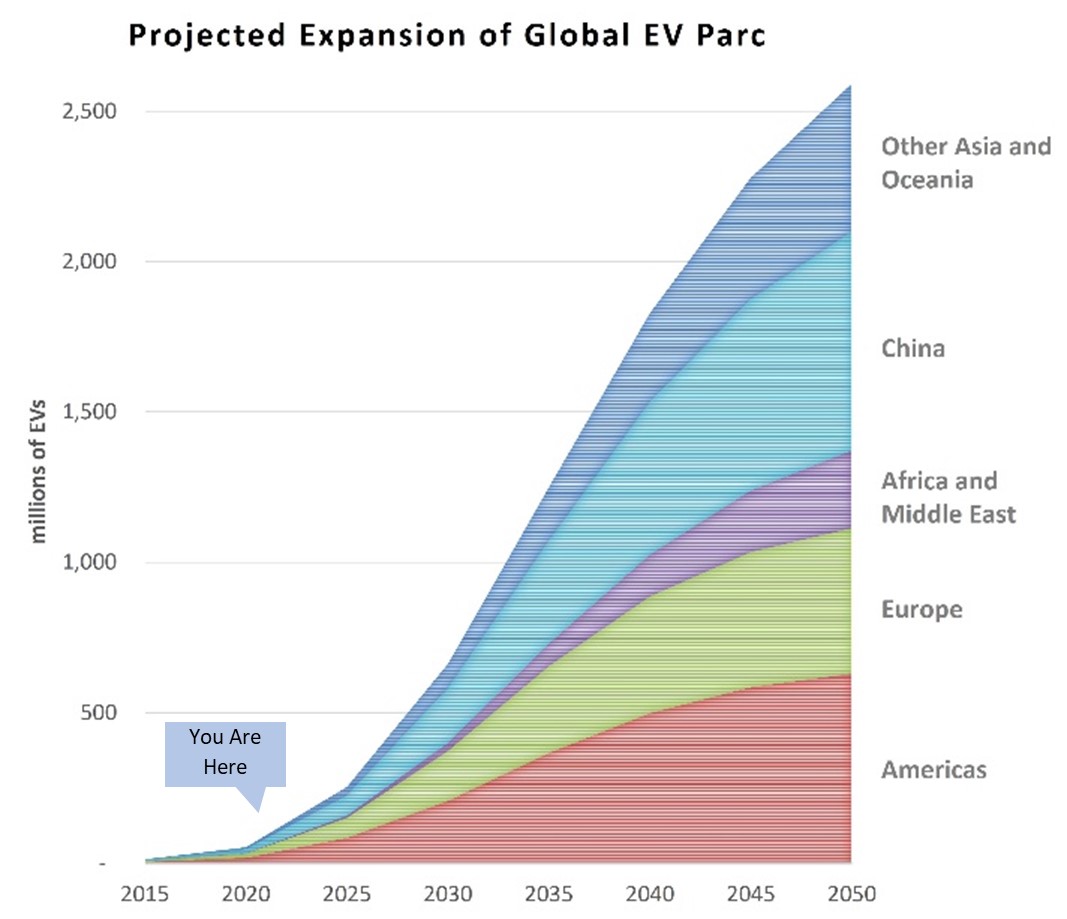

Looking right into the future, however, investors recognise a staggeringly steep adoption curve, driving the opportunity to fund infrastructure that will underpin an accelerating EV transition. Keeping our focus on those same 5 European markets, convergence on the EU’s recommended 10 chargepoints per 100 EVs on a projected 2030 parc of about 60 million EVs indicates a more than 20-fold increase from the existing inventory of nearly 300 thousand chargepoints.

Anticipating the Future by Looking Right

The bottom line is that demand for charging infrastructure is a function of EV adoption, the pace of which is arguably a predictable function of a government mandate. However, in mandating our EV transition, governments oblige infrastructure developers and investors to anticipate where and when demand for charging infrastructure will emerge. Predicting what those adopters will require is a harder but not impossible question to answer.

Our own approach is to look right in deciphering market, economic, political, geographic, and social factors that drive both EV adoption and its associated demand for charging infrastructure. We translate the real-world EV charging experience into the financial return criteria that drives efficient investment.