Amid conflicting and often inflammatory headlines, what is the real state of our transition to electric vehicles (EV)? Across Europe, government mandate is driving us toward an inflection point after which demand for EVs and the charging infrastructure that refuels them will increase dramatically to a zero-emission future.

In his series ‘Ramping Up: Passing an Inflection Point in Demand for EV Charging’, Steer EV lead Alex Georgianna explores the true state of our EV landscape and what this means for investors and operators throughout the automotive, energy and real estate sectors. ‘Ramping up’ brings clear insight to technical, commercial and policy aspects of our EV transition here in the UK, across Europe and throughout the global new vehicle market.

The UK will soon close a public consultation around its ZEV Mandate, which compels 80% of new cars and 70% of new vans to be zero emission from 2030 and 100% by 2035. While considering the implementation of additional measures supporting EV demand (perhaps to include revival of the EV Grant scheme), the consultation is also re-examining:

- The definition of qualifying hybrid vehicles

- The mandated uptake curve for eVans

- Flexibilities around manufacturers’ “banking” and “borrowing” of emission credits

Most of these issues were defined in the Vehicle Emissions Trading Schemes Order 2023, enacted on 1st January 2024. So, what is it that’s causing government to consider revising its position only one year on?

Business Secretary Jonathan Reynolds announced the consultation at a November meeting of the Society of Motor Manufacturers and Traders (SMMT) in response to manufacturer’s claims of the challenges they face in ramping up electric vehicle sales. While confirming government commitment to the 2030 phase out of petrol and diesel vehicles, he indicated a need for “support” around fines charged to manufacturers that miss their ZEV Mandate obligations.

Battle lines seem to be drawn with manufacturers asserting that the ZEV Mandate is overly aggressive in light of only tepid consumer demand. In contrast, clean energy advocates like Transport & Environment indicate that the UK has effectively met its 2024 target in that no manufacturer will receive a fine this year (although many such as Volkswagen, Toyota, Ford and others will be compelled to borrow or buy qualifying credits).

The numbers tell a story

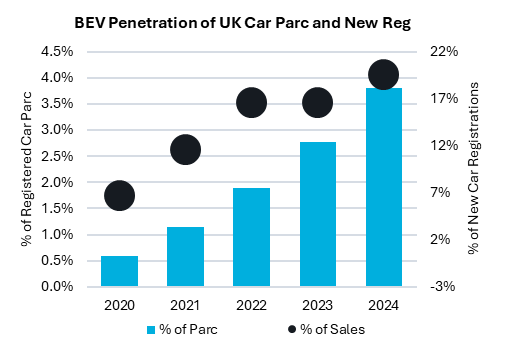

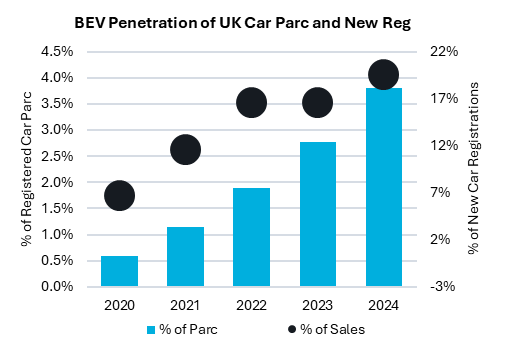

While 2013 indicated a flattening of the rate of growth by which EVs penetrated annual new car registrations, 2024 shows a rebound to just short of the ZEV Mandate target of 22%.

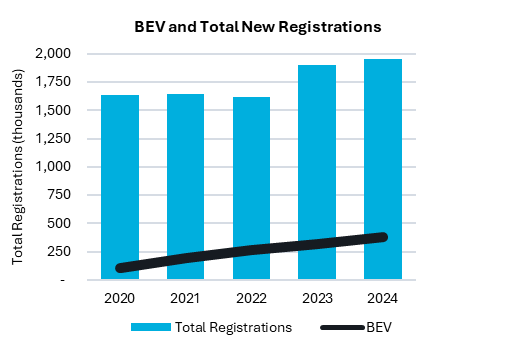

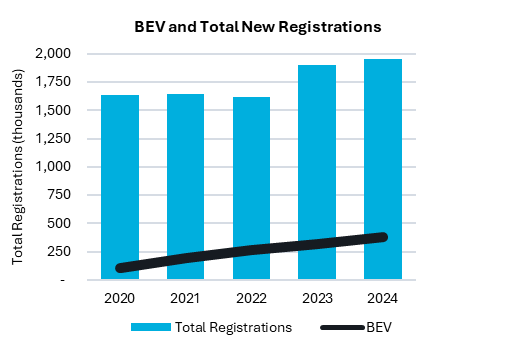

However, when looked at in absolute numbers, sales of new EV demonstrate a linear progression from roughly 100,000 in 2020 to nearly 400,000 by 2024. In fact, it is only the jump in new car registrations in 2023 and 2024 that artificially depresses the penetration percentage of relatively strong EV sales into total new registrations.

When compared with average 2020-2022 annual new car registrations of about 1.6 million, 2024’s 400,000 would have been 25% penetration.

Is there only tepid demand for new EVs?

SMMT indicates that the 3% growth in total 2024 new registrations was attributable to 11% growth in new registrations by fleets & businesses (largely leased vehicles to consumer and commercial customers) that comprised 62% of new car registrations. In contrast, (and as shown in the table below) sales to private customers and businesses fell by 9%. SMMT also reports that EV comprised only 1 in 10 privately registered new cars, tax incentives contribute to a much higher 25% of new fleet and business registrations.

Source SMMT| UK New Car Registration (thousands) |

|---|

| | 2023 | 2024 | 2024

Growth | 2024

EV % |

| Fleet and Business | 1,085.4 | 57% | 1,206.5 | 62% | 11% | 25% |

| Private | 817.7 | 43% | 746.3 | 38% | -9% | 10% |

| Total | 1,903.1 | | 1,952.8 | | 3% | |

So, yes! It does seem that the appetite for new EVs among private registrations is nowhere near as strong as among cars registered to companies or fleets. However, it also seems very likely that this difference relates to a tax subsidy enjoyed by beneficiaries of company car and salary sacrifice schemes (included in fleet registrations) that effectively offsets the retail premium in prices of EVs compared with their diesel and petrol alternatives.

SMMT also indicates that in reaching roughly 20% EV penetration of new car registrations in 2024, manufacturers were compelled to discount retail prices by about £4.5 billion. That’s a big number and we should be wondering from what basis that discount accrues and is it sustainable? Though not perfectly comparable, manufacturers’ “on the road” pricing for the Tesla 3 is about 8% higher than that for the BMW 3 Series. These prices compel the question, what is the fair price that compels both consumer demand and manufacturer supply and what role should public subsidy play in facilitating that market?

So, how’re we doing

I’m thankful that it’s the chore of government to answer these vexing questions and not I. However, we ultimately have very little choice in committing to the broader terms of the EV mandate. The UK is only one element of a much wider market comprised of Europe, North America, Japan and ultimately China, all of whom have all at least broadly signed on to that ban on internal combustion engines by 2035. Automotive supply is a global business with manufacturers serving across global markets. This consultation isn’t just a conversation in the UK, it’s much broader with global manufacturing and their investors addressing its entire marketplace. Heady stuff.

In this consultation, the UK has effectively said, ok, we’ll consider certain adjustments to make terms of the Mandate more “fair”, but there’s no room to step back from the EV transition within the time frames specified. Yes, government may feel compelled to reinstate demand support for EV adoption in the retail segment. A weakening of the flexibilities by which manufacturers can avoid painful penalty may also be somewhat tolerable. But one single market does not fundamentally have the power to step back from 2035 on its own.

For cars, we’re doing all right. We’ve just about hit our mandated target for 2024 and government shows willingness to work with supply around the edges of what is effectively global regulation. The biggest danger here is uncertainty. From vehicle manufacturing to asset finance to deployment of charging infrastructure, each require longer range planning to secure the yields that attract capital finance. Media commentary can be inflammatory, but the global political economy is really in charge here and it’s made up its mind.